The financial consequences of COVID-19 and the shutdown of economies are difficult to evaluate. But some of those consequences have begun to appear and could hinder economic recovery.

The financial consequences of COVID-19 and the shutdown of economies are difficult to evaluate. But some of those consequences have begun to appear and could hinder economic recovery.

Inflation is one of these harmful consequences. In the United States, consumer prices jumped 4.2 per cent in the 12 months through to April, up from 2.6 per cent in March, marking a considerable increase since September 2008.

The same trend is happening in Canada, where inflation rose to 3.4 per cent in April, up from 2.2 per cent in March, the highest level since May 2011.

Inflation can occur when the money supply increases faster than economic growth. For economist Milton Friedman, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

When a central bank prints too much money, that money loses its value. In some countries, profound effects are already present: in Turkey, food inflation jumped by more than 20 per cent in a year after its central bank’s bond-buying program drove its currency to record lows. Similar situations have occurred in Latin American countries like Argentina.

| RELATED CONTENT |

|

| Trudeau’s spending spree hitting Canadian families hard By Gabriel Giguere and Olivier Rancourt |

| Each Canadian owes $56,000 in government debt By Franco Terrazzano |

| And the winner is: more stories of government waste By Franco Terrazzano and Kris Sims |

These situations can lead to hyperinflation – high and accelerating inflation. One of the recent and the most famous instances occurred in Venezuelan. In the face of economic difficulties, the government chose to print more money. This contributed to hyperinflation. The same phenomenon happened in Zimbabwe in the early 2000s. In both countries, the strategy to print money was linked to high governments debt. The need to repay that debt and the mismanagement of national finances can be blamed.

This situation hasn’t occurred in Western countries during the pandemic because their economies were more robust before the crisis. But even if hyperinflation isn’t a concern for those nations, its appearance elsewhere shows the danger of manipulating the money supply. And even minor inflation can hinder economic recovery.

In Canada, according to Equifax, per capita consumer debt declined amid reduced spending activity. If the overall consumer debt has risen due to mortgage balances, household indebtedness fell due to the COVID-19 crisis.

In September 2020, Statistic Canada reported a 10.8 per cent increase in household disposable income. This increase, coupled with a 13.7 per cent decline in household spending (in nominal terms), pushed the household saving rate to 28.2 per cent from 7.6 per cent in the previous quarter and 3.6 per cent in the fourth quarter of 2019.

Numerous factors can explain this situation:

- Lockdowns reduce the opportunities for consumers to spend.

- The future uncertainty caused by the pandemic could lead to more prudent behaviour from households, encouraging saving overspending.

- The Canada Emergency Response Benefit (CERB) provided many people with income from the federal government in response to the restrictions and economic crisis.

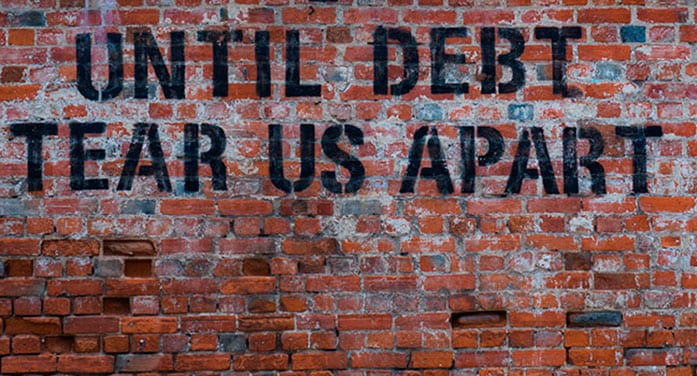

So the government is spending more and households are saving more. This shows that the state is becoming more active in the economy and in managing its debt.

To deal with the COVID-19 crisis, the government has relied on debt and redistributed money to people through subsidies.

The problem is that government money is taxpayer money, so the burden of debt (and the future tax burden) will be costly for citizens, even if they receive financial help from the government.

The COVID-19 crisis has allowed governments to take a more important place in the economy, mainly using debt with help from central banks.

The shock of COVID-19 can explain this behaviour, but we must be wary of the risk of abuse.

Alexandre Massaux is a research associate with the Frontier Centre for Public Policy.

For interview requests, click here.

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.