Taxes alone account for around 50% of the price of beer, 65% of the price of wine, and 75% of the price of spirits

Everything is more expensive these days at the grocery store. We’ve also seen increases at the liquor store, or wherever you purchase your favourite alcoholic beverages. Well, these products are about to get more expensive yet again.

Everything is more expensive these days at the grocery store. We’ve also seen increases at the liquor store, or wherever you purchase your favourite alcoholic beverages. Well, these products are about to get more expensive yet again.

In 2017, the federal government had the brilliant idea of indexing taxes on alcoholic beverages to align with inflation. It’s called an escalator tax on alcohol. The idea was to make hikes more predictable, but without any parliamentary oversight or consideration for changing market conditions. Despite concerns registered by our alcohol industry, Ottawa marched on.

Before the pandemic, inflation was not as significant an issue as now. Few noticed that taxes on alcohol increase every year. But the shock will hit us this year due to our very high inflation rate. So in a few weeks from now, on April 1, that tax will increase by 6.3 per cent, making it the highest increase ever. Canadians will have to pay an additional $125 million in taxes per year, starting April 1, when buying beer, wine and/or spirits.

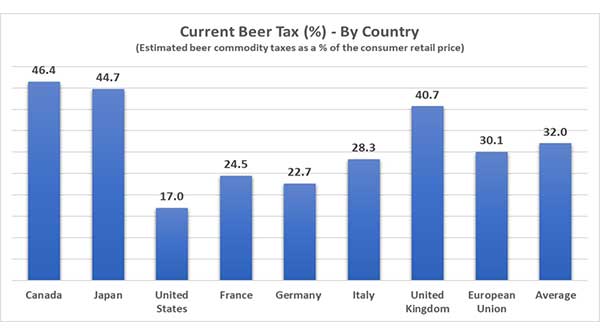

Canada already has the highest alcohol taxes amongst G7 countries. In fact, taxes alone account for around 50 per cent of the price of beer, 65 per cent of the price of wine, and 75 per cent of the price of spirits.

We have seen five consecutive hikes since the escalator clause was implemented in 2017, which allowed Canada to surpass Japan with the highest tax rate on alcohol in the industrialized world. For anti-alcohol advocates, this may be seen as encouraging news. Making alcohol more financially prohibitive will get consumers to drink less. It makes perfect sense from a public health perspective, which is clearly what Ottawa is going after. Fiscal measures impacting alcohol consumption are nothing new, but Canada is now reaching a point where an entire industry can be negatively affected by our government’s thirst for more tax dollars, no pun intended.

The market size for Canadian breweries will exceed $7.5 billion by the end of this year. Over 17,000 people work in the beer industry alone. We now have more than 1,200 breweries and microbreweries in the country, and many are operated by craft brewers employing just a handful of employees. The wine industry contributes almost $12 billion to our economy at present. And, of course, we have restaurants, pubs, and bars, which all rely on alcohol sales to make a living.

The food service industry is already hurting. According to Restaurant Canada, in 2022, in many provinces, for every restaurant opening, two establishments closed. And that trend is likely to continue into 2023. As a result, the ripple effect of increased prices on the alcoholic beverage industry is clearly measurable. Across Canada, beer sales are down 3.6 per cent over the last 12 months, according to Beer Canada.

Liquor boards will also be impacted by the tax increase. Gross profits for all liquor authorities and government revenue from sales of alcoholic beverages across the country now reach almost $10 billion per year, according to Statistics Canada. These sales are helping provinces fund hospitals, schools, roads, and other infrastructure they need to maintain.

We learned from similar increases in tobacco tax that higher prices might lead to an increase in illicit activities as consumers seek cheaper alternatives. For alcohol, this means bootlegging and smuggling, which can negatively affect public health and safety, as illicitly produced alcohol may be of lower quality and pose greater risks to consumers. This is not the road we want to take, especially right now.

Some maintain the escalator tax, which few Canadians know about, is undemocratic because of the lack of parliamentary oversight. Perhaps, but there is no denying that the escalator tax will eventually make all legal alcohol products in Canada less affordable.

It may be time for Parliament to step in and investigate the escalator tax and see whether it should be capped or at least a ceiling clause of some sort set when inflation reaches a certain level.

Ottawa, after all, has already benefited from inflation: the federal government’s deficit has melted away to about $4 billion in the last eight months. Ottawa doesn’t need more revenue from “sin taxes.”

Ottawa should protect our agri-food industry as much as possible by making it attractive to investors while offering high-quality, decently-priced food and beverage products to Canadian taxpayers.

Or else, with higher taxes, many companies will flee Canada, eliminating options and reducing competition, thus pushing prices even higher.

Dr. Sylvain Charlebois is senior director of the agri-food analytics lab and a professor in food distribution and policy at Dalhousie University.

For interview requests, click here.

The opinions expressed by our columnists and contributors are theirs alone and do not inherently or expressly reflect the views of our publication.

© Troy Media

Troy Media is an editorial content provider to media outlets and its own hosted community news outlets across Canada.